The working version of the report from the joint conference RICS-NAVS prepared by Real Estate Magazine (http://realestate-magazin.rs/) is submitted below.

The full version will be available after the autumn issue is printed.

Covid only accelerated the changes already present in the real estate market

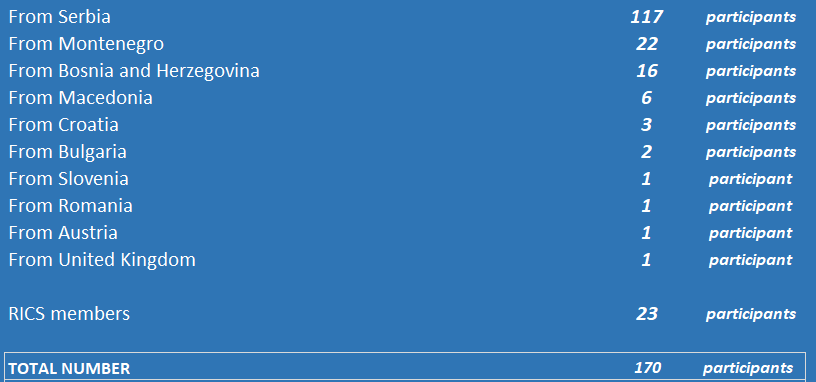

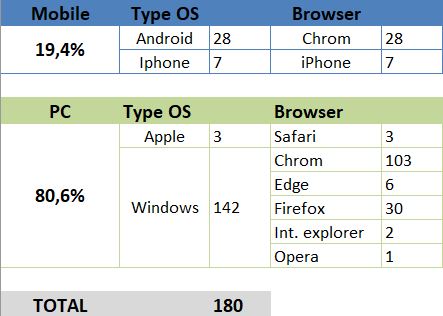

The second joint conference RICS and NAVS (National Association of Valuers of Serbia) due to the corona virus pandemic was held via video link, and the topic of the conference “Current trends and opportunities in the market of Southeast Europe and the role of professionalism in further developing our markets” gathered 170 participants from ten countries.

18 panelists from Serbia, Montenegro, Bosnia and Herzegovina, Croatia, Romania and Great Britain talked about current events at the global and regional level. As Danijela Ilić, the president of NAVS, assessed at the very beginning of the conference, today, when the world is in the process of great changes, professionals are needed more than ever before. Advocacy of the highest ethical and professional standards, market transparency and data insidiousness are values that protect the industry in challenging times.

Construction industry: short-term and long-term effects of the COVID-19 pandemic

The beginning of the corona virus pandemic, and especially the time of the state of emergency, put the builders in front of new challenges, the participants of the first panel of the conference, which was dedicated to the topic “Construction industry: short-term and long-term effects of the COVID-19 pandemic”, pointed out.

Security measures on construction sites, reduced number of people in offices, provision of protective equipment for workers, as well as the suspension of transportation, but also the closure of borders, were problems that the contractors faced on a daily basis. “The construction industry is quite resistant to new circumstances and we are all quite flexible,” said Ognjen Kisin, CEO of Konstruktor Group.

“The Konstruktor was lucky that at the beginning of the pandemic we were in intensive contact with partners from China, as well as Western countries that have production in China, which have already passed that cycle, when he came to Serbia, so we prepared for a pandemic. The problem was the movement of labor, but also the procurement of certain materials. The conclusion that can be drawn from this period is that a local workforce is needed. “Serbia has a problem with this segment, having in mind that there is no localization of construction companies that existed before,” Kisin pointed out.

Similar problems existed in Montenegro. “Our job requires a qualified workforce that does not exist in Montenegro, so we had operational problems during the realization of the started facilities. The labor force coming from Bosnia and Herzegovina could not cross the border, the national coordination body of Montenegro was not efficient enough, so in the first moments there were a lot of problems that were solved in progress,” said Dragan Lalic, Executive Director Sirbegovic Engineering, who pointed out that the recovery of the construction sector to the level before the corona virus pandemic can be expected only in 2022.

Zeljko Disic, director of REFLEKS Sabac, pointed out that the policy of this company was to work in their environment before, which turned out to be a mitigating circumstance during the period of emergency. In addition, this company is investing in its own facilities, which has amortized any problems in the second segment of business, given that the sale of real estate continued during the pandemic.

Ana Maria Olteanu, RICS Accredited Mediator, Senior Commercial & Claims Manager, at Optim Project Management, stressed that a distinction should be made between the private and public sectors, which were affected differently by the overall situation due to the corona virus pandemic. “In Romania, the public sector had the support of the state, so there were no interruptions in funding. When it comes to the private sector, the main developers acted cautiously, which caused a domino effect that was reflected on the entire chain. When it comes to contractors, there is no option of remote work and it is necessary to maintain the work, but construction companies have proven to be resistant to a pandemic. It is necessary to overcome financial problems and we certainly have to adapt to the new times and challenges it brings. ”

Ognjen Kisin also pointed out the possible problems in the functioning of companies from the construction sector from the Balkans, emphasizing that we will see the first results at the end of the year and that some companies will have financial problems. “Now we are in the period when the contracts concluded before the pandemic are being realized, but the question of investment cycles is being raised, and that can be reflected in the business in the second half of 2021,” said Kisin.

Damir Prenković, director of the company Invekon gradnja and moderator of the panel, underlined that the new situation only further aggravated the problem of lack of qualified labor.

Dragan Lalic believes that the state should popularize construction occupations in the entire region, so that the domestic labor force would be interested, especially because of the fear of new closures of the borders that we faced at the beginning of the year. “During the pandemic, Macedonian workers could not return to their homes, which had a major impact on them, and therefore their ability to work.”

Problems with the labor force are also present in Romania, and Prenković pointed out that the growth of salaries in this sector is not a guarantee that people will stay, noting that the growth of the average salary in construction in Romania during the period 2015-2020. year jumped 200%, but the migration of the population to Western Europe continues.

Ana Maria Olteanu confirmed these data, emphasizing that there is a simultaneous growth of investments in both the private and public sector, but also the departure of labor. “Wage growth is the result of government support. Since last year, we have a law on support for the construction industry, as a result of which taxes have been reduced, because it has been recognized how important the construction sector is for the Romanian economy. But it is difficult to convince people who have left to return. I believe that construction companies working in Romania should also create better conditions and convince people to return or new generations not to leave the country and in that way we all participate in the efforts to keep the construction industry going. We are talking about skilled labor and imports from Asia, but in Romania we still need good engineers to oversee construction projects. ”

“There is a disproportion between the wishes of employees and what the market provides. In the last 20 years, real working hours have been lost, which are on the construction site 10 hours a day, 6 days a week, and such long working hours are not efficient. I do not think that construction will stop, but we will lose a lot if we do not save the domestic workforce and do not educate young people who will be the engine of further development. Today, we have an extremely high age limit for employees on construction sites. The Konstruktor specifically does not have a significant outflow of resources due to good working conditions, but the problem is that we cannot expand the business due to lack of resources and we are trying to solve that problem,” Kisin explained.

Participants also touched on the issue of reducing the cost of residential real estate, which the public expected, but the panelists agreed that construction costs were also increased during the state of emergency, and that these increased costs were not passed on to investors.

Vladimir Nikolić, technical director of ZOP Inženjering, pointed out that everyone was of the opinion that the prices of construction would fall, and thus the price of apartments, but that is not happening. There was an increase in costs, nothing additional was asked from investors, but investors also showed understanding for the deadlines. ”

The deadlines were certainly affected by the supply of construction materials, the chain of which was endangered during the state of emergency. “Montenegro imports complete construction material. During the state of emergency, trucks were stopped, but the procedures were extremely complicated, they waited at the borders for about ten days, so the construction site stood,” Dragan Lalic pointed out. “In some countries, factories also stood due to local regulations due to the corona, it was difficult to find an alternative supplier, ie a manufacturer, and the price of transport was increased.”

There were problems in Romania at the beginning of the pandemic due to the restriction of movement, but they lasted for a week to two weeks, so they did not affect the construction processes too much, and fortunately, Romania has several factories.

“The corona pandemic will influence the philosophy of the construction material supply chain. It is rare for a factory to have a warehouse, and the crisis has shown us that there can be a longer period in supply that can cause large losses. Serbia imports a huge amount of construction materials, and representatives rarely have serious stock. A new wave and closing of borders can be problematic, so a lot of suppliers will probably change the current way of functioning,” Kisin concluded.

News on the residential real estate market in the Western Balkans

The second panel was dedicated to the topic of news in the residential real estate market. Kaća Lazarević, the moderator of the panel, pointed out that not everything was so rosy with the introduction of emergency measures. “We tried to work all the time with precautions. There were those who were scared, but also those who wanted to get moving. We were followed by banks, notaries, but RGZ closed, which made the situation more difficult. Now that the corona is present and we live with it, we seem to be doing better. In June, over 10,000 real estate transactions were registered in Serbia, but still the level from last year was not reached,” Lazarevic pointed out.

“Everything is causally consequential. The pause we had at the beginning and the fear are real due to the messages we could hear and which ordered “stop”. This gives a situation in which interested buyers stop, so in this period we can not say that we had a decline, but stagnation, which is natural according to the situation,” said Milos Stanojevic, Consultancy Parnter at West Properties. Stanojevic also pointed out that there are no changes in the residential real estate market in Serbia, because the jump that was recorded in June compared to last year is unnatural and is a consequence of the blockade and the impossibility of showing real estate and doing business during a state of emergency. “The role of real estate intermediary is regaining its true meaning in these times,” Stanojevic points out. “In the overall situation brought by corona as a buyer, you are looking for the support of a consultant who will provide quality response and professional guidance, and West Properties is working intensively on that. ”

In Croatia, in addition to the corona, the earthquake had a great impact on the real estate market in Zagreb, when the city center was damaged, said Boro Vujović, director of Operetta Real Estate. “Due to this situation, the real estate market in the center of Zagreb practically does not exist. A certain number of buyers opt for other city locations, and some buy land on the periphery and build themselves or buy houses. On the other hand, cottages in the Lika area have been sparsely populated so far, with low prices, and after the corona, a large number of people bought agricultural land, and house prices jumped almost twice. ”

There is also a great demand for cottages in Bosnia and Herzegovina, said Maho Taso, director of PROSTOR Real Estate. “This trend is already slowly declining, but it is certainly higher than last year.”

“The fact that the sale of cottages jumped 40% in Serbia only confirms that this is a trip due to the inevitability and the current situation. And that trend will pass,” Stanojevic agreed.

When it comes to foreign investors in Serbia, when asked if they have stopped during the previous six months, Ivan Gazdić, partner, CMS Belgrade, says that everything depends on the sector in which the investor works. “Investments are significantly conditioned by the affinity and readiness of banks to finance projects. During these six months of the crisis, banks gave up financing the development of the hotel sector, but also the projects of business facilities in Belgrade. It seems that logistics has not been so affected, and investors still recognize this segment as a model where it is still profitable to invest. As for the retail sector, it would be said that retail parks were less affected than shopping malls, due to their very structure and the absence of a centralized climate. Although in the first rush the retail sector was directly affected by the closure, the recovery is happening to a greater extent than it is with office space, which will have to be transformed into a more flexible form in the long run because people still work from home. ”

Gazdic also pointed out that the risk of uncertainty creates stricter financial conditions, and that some banks have increased the interest rate on housing loans, which is in conflict with the NBS’s recommendations to make loans more accessible.

When asked whether it is a good investment to invest in real estate or keep money in a bank, all participants agreed that the population in the Balkans is investing in real estate, and that the advantage is mostly new construction.

“After the earthquake in Zagreb, new construction is even more popular, because previously there was no awareness of the uncertainty that exists,” Vujovic points out. “New construction is more popular, but it is not enough and there are no large and luxurious projects. Certain projects are in the pipeline, so we have waiting lists for individual investors. The interest rate in the bank is negative, the annual return when buying real estate is 4%, so we save “in bricks” because we do not have education for saving in funds and in other ways, except by buying real estate. A large amount of money is being printed and the question is whether it is better to have money in physical form or a property in a good location that can be rented. ”

As for Sarajevo, the demand for new construction is far above the supply. “Maintenance of buildings is an objective problem of old construction, so new construction, which is being built today in mostly worse locations, primarily on the periphery, still has an advantage. “The financial market is underdeveloped and still has negative connotations, so people invests in real estate, because there is no alternative,” said Maho Tasso. “Buyers of new construction are willing to advance larger amounts for projects in conception, and a more well-known investor brings a higher response to the advance payment.”

Buyers are much wiser today, Milos Stanojevic emphasized. “They are much more educated about the types and quality of facilities, the culture of investment maintenance. New construction does not imply quality. As an experienced company in the real estate market, we help our customers with adequate advice, because what is valued today is the quality of life. ”

Referring to the growing number of foreign investors on the Serbian market, Ivan Gazdić pointed out that investors usually divide the project into several phases. “In that situation, banks are interested in financing from the first phase onwards, depending on the results, which will provide guidelines for further development of the project.” It seems to me that project financing has introduced better market discipline and security in our country as well, because an investor who plans to take project financing is familiar with what he has to do – to have a clean company that is only established for the development of that one project. At the same time, it is important that the location is clean because of the bank’s loan, “said Gazdić, who emphasized that the Foreign Investors Council had various proposals on how to recover the real estate market as soon as possible. “We sent a proposal to the ministry to reduce the amount of contributions for the arrangement of construction land, the amount of conversion of the right of use into the right of ownership on construction land, we proposed to allow construction based on the right of use in some 12 months, to allow registration of works before payment.”

Talking about the fact that New Belgrade is currently in the lead with locations and whether some investors will return to the city center, where possible, Milos Stanojevic pointed out that New Belgrade as the largest business zone offers the greatest opportunities and will continue to hold the lead in squares under construction. “Dorcol and the lower part of the old part of the city will continue to develop, we have serious projects at locations in this part of Belgrade, but also the effort of the city administration to arrange that space, gives serious potential.” Belgrade has other very interesting locations – such as certain locations in New Belgrade itself, such as the vicinity of the Hotel Yugoslavia, or in the area of the old part of the city of Marina Dorcol and the Port of Belgrade. Such locations will provide exactly what the mass market enjoys, and that is to have comprehensive, time-saving facilities, isolated from the city noise. Certainly, each city zone will have its own development,” said Stanojevic.

Adapting to a new norm in the assessment industry

Covid only accelerated the changes that were already present, but did not change the world, according to Nick French, Real Estate Valuation Theurgy Property Education Chichester. “As a society, we went towards working more from home, and that is just one of the examples that slowly took over the primacy, but it happened quickly. In the center of London, retail outlets in the city center have been decaying for some time, and this space will probably be adapted in the future. Retail is recording higher results than before Covid, due to the incredible increase in online shopping, and on the other hand, people do not spend money on summer trips, but in other ways, including arranging their real estate. ”

Speaking of London, there is currently great interest in the residential segment as well as the logistics segment, but there are not too many transactions in the office segment, French pointed out.

When it comes to real estate appraisals, French points out that clients need to understand that there is a certain uncertainty of the appraisal itself nowadays.

In the history of RICS, the material uncertainty clause has been presented only three times, one of which is related to the corona virus pandemic. “This requires the appraiser to change the mindset and use all available resources and draw a conclusion,” said Srdjan Runjevac, senior expert associate for collateral management at Erste Bank. “All creditors and investors are withdrawing from some of the processes they have initiated so far. Fortunately there were transactions and during the duration of material uncertainty and in that situation special care is paid to each case. Banks in Serbia and around the world react to the presence of such a clause, which again differs from case to case. It is assumed that the percentage represents all the necessary data to the client, the banks are provided with additional information. In cases such as the covid pandemic, banks turn more to the analysis of their portfolio and its management and determine how much this clause has an impact on their portfolio and further business,” Runjevac explained.

Runjevac agreed with French that certain changes were knocking on the door even before the pandemic, as is the case with the hotel industry, but also the office and retail segment.

Speaking about the novelties in the valuers industry, ie the introduction of AVM – model of automatic appraisal, the participants pointed out that this change is definite and that one should not spend energy on proving whether it is good or bad, but rather talk about other aspects of automatic appraisals and define the way on which a new trust on the market and new transparency will be established, because, when we talk about Serbia, the Law on Valuers has existed since 2018, and we are already talking about automated models.

As the panelists pointed out, it is necessary to educate all market participants about the new models, in order to be ready for changes, and it is necessary for the regulators to hear all wishes and plans, mostly to the banking sector. It is definite, however, that the role of the valuer will inevitably be necessary – the simpler the automated models and the smaller the role of the certified valuer, the certified valuer must define the model and harmonize it with market practice and standards, verify it and stand behind it. All aspects of automated models should be considered critically, what they can provide to practice and the market, and how to apply them depends on the country, on the availability of data, their quality, keeping data in line with GDPR and using that data.